- Ipin 1 13 – Secure Pin & Password Safe Mode

- Ipin 1 13 – Secure Pin & Password Safety

- Ipin 1 13 – Secure Pin & Password Safe Reset

Tax season can be hectic. Unfortunately amidst the hustle and bustle of tax season, it is easy to fall prey to identity theft and all the challenges that come with it. Fotojet designer 1 1 8.

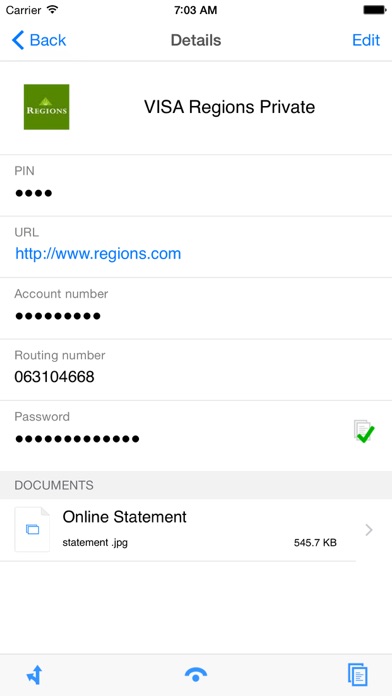

A personal identification number (PIN), or sometimes redundantly a PIN number, is a numeric or alpha-numeric passcode used in the process of authenticating a user accessing a system. The personal identification number has been the key to flourishing the exchange of private data between different data-processing centers in computer networks for financial institutions, governments, and enterprises. The IRS has expanded the number of states by 10 for which residents can voluntarily apply for an Identity Protection Personal Identification Number (IP PIN). This expansion was announced by the IRS in its e-News to Tax Professionals email subscription sent out on October 4, 2019. KISS - keep it simple and secure iPIN tries to fulfill the KISS principle. IPIN was developed to store and display PINs and passwords - no more and no less. So the focus is on simplicity, clarity and high level of security. Password Safe Pro Version without any ad and permissions. Encrypted notes. Sticky Password Manager & Safe.

Have you ever received a phone call from the IRS? You've been a target of an IRS scam. As a rule, the IRS will never contact you by phone unless you have requested to be. Anyone who contacts you claiming to be the IRS is attempting to commit fraud.

Though the IRS continues to take preventative measures to assure fewer taxpayers are affected each year, there is still potential for you to fall victim to tax return identity theft. In an effort to protect taxpayers, the IRS created the IP PIN program.

Click on one of the following questions to jump straight to the answer you're looking for:

- Am I Eligible for an IP PIN?

Abbreviated as an IP PIN, an Identity Protection Personal Identification Number is a six digit number created and distributed by the IRS to protect you from identity fraud. The IP PIN is used as an extra layer of authentication security to confirm your identity when filing your tax return. The six digit code makes it harder for potential tax thieves to use your Social Security Number to submit fraudulent paperwork—protecting you from would-be criminals.

Since this number is unique to you and the key to accessing your annual financial documents, it is important to keep your code completely safeguarded. You should never reveal your IP PIN to anybody other than your tax preparer or an IRS tax advocate. You will only need to reveal your IP PIN code when your tax return is complete, revised, and ready for your signature and submission.

The IRS will issue you a new IP PIN each year, ensuring that each year's PIN is unique to you and cannot be discovered. The number is issued in late December or early January, ensuring that you have plenty of time to solve any issues that may occur with your pin (more on that below).

Am I Eligible for an IP PIN?In order to determine your eligibility for an IP PIN, ask yourself these three questions:

- Did you receive a CP01A Notice from the IRS?

- Did you receive an invitation to ‘opt-in' for an IP PIN from the IRS?

- Did you file your federal tax return as a resident of the District of Columbia, Georgia, or Florida last year?

1tb chip for macbook air. If you answered yes to any of these questions, you are eligible for an IP PIN.

Do I need an IP PIN?Your answer to the above questions will determine your need for an IP PIN. New macbook air programming.

- If you answered yes to the first question, you will need an IP PIN

- If you answered yes to the second and third questions, whether or not you use an IP PIN is up to your discretion

In an attempt to proactively protect the public from identity fraud, the IRS often invites taxpayers to opt in for an IP PIN when paying their taxes. If you've received an invitation, it's wise to accept. IRS phone scams and malicious phishing are still out there, so it pays to be vigilant. There is no such thing as being too safe when it comes to finances; use the IRS to your advantage and add that free layer of security.

This is especially true in Florida, Georgia, and the District of Columbia, the three highest per-capita locations in the nation protected from tax-related identity theft. Unique to all 47 other states in the United States of America, residents of Florida, Georgia, and the District of Columbia do not have to be victims of identity theft in order to participate in the IP PIN pilot program.The results of this pilot program are overwhelmingly positive. With increased future funding, the IRS hopes to distribute IP PINs across the country.

Ipin 1 13 – Secure Pin & Password Safe Mode What is a CP01A Notice?If you received a CPA01A notice from the IRS, that means you have been a victim of an identity fraud. In this case, the IRS issues you an IP PIN to protect you on your next tax return. In the event that a person who is not you attempts to file taxes using your Social Security Number, your IP PIN will notify the IRS of the fraud.

How do I get an IP PIN?If you received a CP01A notice, your IP PIN will be listed on your notice. The six digit code is located at the bottom of the first column. Keep this file in a safe and secured location each year as it will be the key to confirming your identity on all federal tax documentation for this year.

How to request an IP PINIf you want to register to use the IRS IP PIN service, here's what you'll need.

Ipin 1 13 – Secure Pin & Password Safety- Your Social Security Number and date of birth

- Your filing status

- The mailing address from your last tax return

- A mobile phone line with your name on the account

- Access to your personal email account

- Your credit card number

- Home mortgage loan, student loan, home equity line of credit, and auto loan account numbers also qualify as identity verification documentation.

Once you've gathered all of your information, you'll need to verify your identification through the IRS online services account.

How to login to IRS online servicesFirst time users will be required to

- Provide SSN, DOB, filing status and last filed address

- Provide your name and email address to receive a confirmation code

- Enter the emailed confirmation code

- Provide a cell phone number to receive a six digit activation code via text or request an activation code through the mail.

- Create a username, password, and an extra security site phrase

Returning users will be required to

- Log in with existing username and password credentials

- Retrieve a security code through text message

- Users are also given the option of accessing their account via the IRS2Go app available for Androids, iPhones, and Amazon Fire tablets.

You are required to use your IP PIN when submitting the following tax documents: Elmedia player pro 6 13 – multi format media player.

You are required to use your IP PIN when submitting the following tax documents: Elmedia player pro 6 13 – multi format media player.

- Form 1040

- IRS Form 1040 PR/SS

- Form 1040A

- Form 1040EZ

These are the only four tax returns that you need to use your IP PIN for. You do not need to use your IRS IP PIN to file your state tax return. Whether you are e-filing or sticking to pen and paper, you still need to attach your IP PIN to the end of your return.

What do I do if I lost my IP PIN?In the event that you lose your IP PIN, you can retrieve your lost IP PIN online through the IRS' online services. You'll be required to provide the following.

- Your Social Security Number

- Your e-mail address

- Your filing status and most recently filed address

- Your cell phone

- Your personal account number – the credit card or loan account you registered with

After going through the secure verification process, you'll be able to retrieve your IP PIN.

How can I replace my IP PIN?If you cannot retrieve your PIN online and need to replace your IP PIN, you can do so by contacting the IRS Identity Protection Specialized Unit. Note that, if using a replacement PIN, you should expect a delay in the processing of your tax return and reception of your refund.

Remember that you'll be issued a new IP PIN each year, so if you've already filed taxes for that year using your IP PIN, the number will be of no use to you any longer.

IRS IP PIN Phone Number Ipin 1 13 – Secure Pin & Password Safe ResetIf you need to replace your PIN, contact the IRS at 800-908-4490 ext 245.